- Neighborhoods

-

Community

-

- Overview History Vision Newsroom News Releases Pilot Newsletter Media Contact Projects Volunteer

- Engage Milwaukie Events City Calendar Recreation Biking in Milwaukie Parks and Trails Directory North Clackamas Parks and Recreation Reserve a Room Library

- Schools North Clackamas School District MHS Student of the Month Public Safety Police Clackamas Fire District #1 Code Compliance Emergency Preparedness Emergency Notifications Garbage & Recycling

-

- Business

- Departments

-

Useful Links

-

- Jobs Alerts & Notifications Email Subscriptions Emergency Notifications Meetings City Services A-Z Mapping & GIS

- Contact the City Staff Directory Request a Public Record Report a Code Violation Report a Pothole Report Misconduct Schedule an Inspection Documents & Forms Documents and Reports Forms, Permits, and Applications

- Helpful Links Digital Archives Library Catalog Municipal Code Purchase a Parking Permit Paperless Billing Pay a Ticket or Utility Bill Urban Forest

-

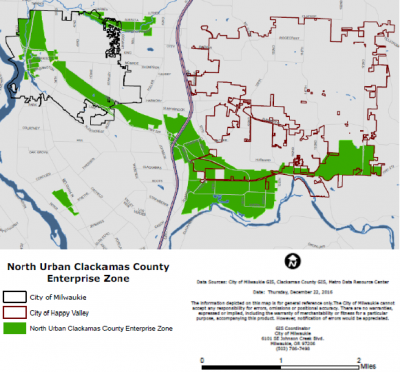

North Urban Clackamas County Enterprise Zone

Enterprise Zones are part of a State-initiated tax-abatement program available to businesses looking to locate or expand in a designated zone. Qualified businesses may be eligible to receive exemption from local property taxes on new investments including building construction and improvements, machinery, and equipment, for a period of three to five years.

Standard Incentives available to eligible businesses:

- Construction-in-Process Enterprise Zone Exemption - For up to two years before qualified property is placed in service, it can be exempt from local taxes.

- Three to five consecutive years of full relief from property taxes on qualified property, after it is in service.

- Additional local incentives may be available.

Criteria for Qualifying Projects

Three-year exemption:

- increase full-time, permanent employment by 10%

- pay employees at least 150% of the State minimum wage (benefits may be used to reach pay level)

- maintain minimum employment level during exemption period

- enter into a first-course agreement with local job training providers

- pay an application fee of 0.1% of the proposed total investment

Five-year exemption:

Businesses should meet the three-year exemption criteria as well as:

- compensation of new workers must be at or above 150% of the County average wage (benefits may be used to reach this pay level)

- local approval by written agreement with the local zone sponsor (City of Milwaukie)

For more general information and on how to apply see the documents below and visit the Clackamas County website here.

Clackamas County Contact:

Zone Manager

Cindy Knudsen

CKnudsen@clackamas.us

503-742-4328